Download

mystc app today

Search our FAQs

Yes, you need to have mobile internet to purchase apps or in-apps. Data can be either Mobile Data Service provided by your mobile operator, or any Wi-Fi connection.

Yes, you can use a local Wi-Fi to purchase apps or in-apps in a foreign country.

Yes, you need to set up your stc Carrier Billing first to start purchasing apps on Apple Stores.

You can do this on your iPhone, iPad, iPod touch and Mac, or on iTunes from your PC.

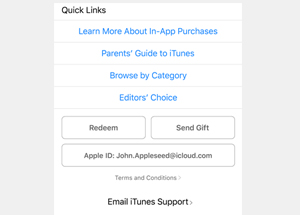

1. Go to the App Store

Scroll down to your Apple ID and tap on it.

2. Tap on 'View Apple ID'

Enter your Apple ID password.

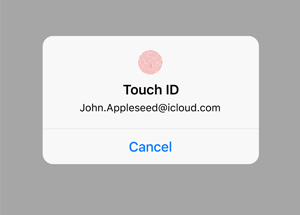

3. Scan your fingerprint

If you have Touch ID activated.

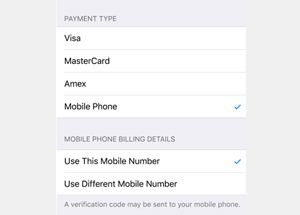

4. Tap on payment information

5. Choose 'Mobile phone' as a payment type

You have the option to choose your stc number on the device or a different stc mobile number.

You should receive an SMS and email confirming this payment method. When that’s done, you’re all set!

VAT is a consumption tax that the end user is obligated to pay, and stc will only be acting as a collection agent on behalf of the Authorities. Both individual and business customers will be required to pay VAT on goods and services purchased from stc.

VAT will be introduced in the Kingdom on the 1st of January 2019.

VAT will be introduced in the Kingdom on the 1st of January 2019 at the Standard Rate of 5% on all goods and services unless the VAT Law specifically provides that such supplies are Zero-rated, Exempt or outside the scope of VAT.

The majority of Telecommunication goods and services fall within the Standard rate of 5%.

A 5% VAT will be added to the postpaid bills upon issuance of the bill.

VAT for prepaid is applicable at 5% when you use your prepaid credit balance regardless of when the recharge has been performed.

As per the VAT executive regulation, it is mandatory for all registered businesses to charge VAT on all goods and services offered. As of January, 1 2019, stc must charge VAT on all its products and services at the applicable rate.

VAT-registered businesses must submit VAT returns to the National Bureau for Taxation declaring all the amounts of VAT they have charged and the amount of VAT they have incurred in each tax period.

For further details, please visit https://www.nbt.gov.bh/FAQ

For reference, businesses can register for VAT through the NBT Website https://www.nbt.gov.bh/form